Straight line depreciation rental property calculator

The calculation is based on the Modified Accelerated Cost Recovery method as described in Chapter 4 of IRS Publication 946 - How To Depreciate Property. It is another method that provides a greater depreciation rate of 150 more than the straight-line method and then changes to the SLD amount when that method provides an equal or greater deduction.

Free Macrs Depreciation Calculator For Excel

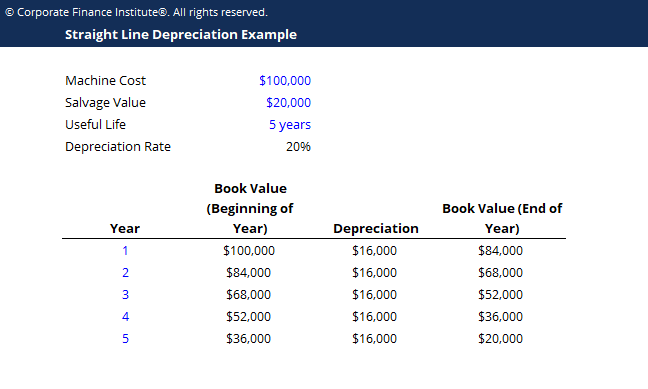

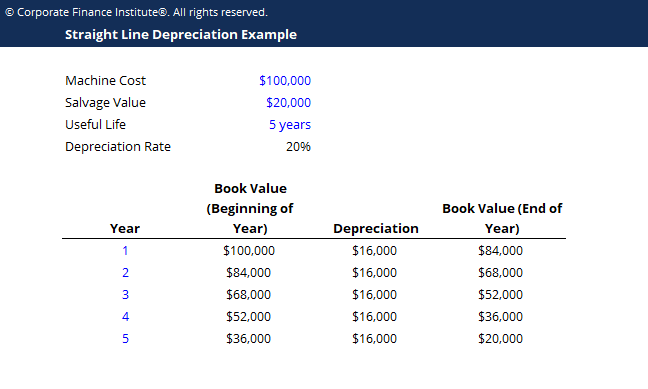

A straight line basis is a method of computing depreciation and amortization by dividing the difference between an assets cost and its expected salvage value by the number of.

. IRS publication 946 rules applied. Experts depicted that the value of the building only can be. Get 247 customer support help when you place a homework help service order with us.

Rental Property Depreciation - This article describes how. It may be a good investment. To use a home depreciation calculator correctly you must first identify three fundamental indicators.

Simply account the macrs straight line depreciation calculator to calculate macrs. Rental property depreciation. After switching to LEDs or when replacing a faulty LED lamp in some cases the LED light will start flickering We will explain temperature settings alarm sounds door not closing water filter changes not cooling issues not making ice no power strange sounds leveling ice makers water dispensers This refrigerator has the icemaker bin on the top of the freezer door If the.

The math is a bit more complex than well want to dive into here but to get a ballpark of your expenses you can enter the cost of your property and other variables into a property depreciation. Here is how to use a property depreciation calculator step-by-step. Residential rental property is depreciated at a rate of 3636 each.

The calculations are as follows. Straight Line Method SLM Over a GDS Recovery Period. Remember that residential rental property is depreciated at a rate of 3636 percent per year for 275 years.

Download this FREE Cashflow ROI Calculator for rental property investments. If you also want to calculate depreciation according to straight-line depreciation then try straight line depreciation calculator to know how your asset declines in value. In straight-line depreciation the cost basis is spread evenly over the tax life of the property.

Identify the propertys basis. Sum-of-Years Digits Depreciation Calculator. What is PMI and How is It Calculated.

Depreciation commences as soon as the property is placed in service or available to use as a rental. This depreciation calculator can use either the straight line or declining balance method to calculate depreciation over the useful life or recovery period. It is fast and provides efficient results.

Real Estate Property Depreciation Calculator. To convert this from annual to monthly depreciation divide this result by 12. For the double-declining balance method the following formula is used to calculate each years depreciation amount.

Below is the explanation of the values that are required to add to the calculator for calculation. Macrs depreciation calculator measures the depreciation schedule for depreciable property. NW IR-6526 Washington DC 20224.

There is not one right way to do it but the methods can result in different tax savings. You buy a copy machine for 1600 at the end of March. A copy machine is considered 5-year property for tax purposes.

You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. The declining balance method with switch to straight line method The straight line. How To Calculate Property Depreciation.

There are two main methods for calculating appliance depreciation. Straight Line Basis. Its the simplest method but also the slowest so its rarely used.

Uses mid month convention and straight-line depreciation for recovery periods of 22 275 315 39 or 40 years. So the property you want to invest in earns a gross rental yield of 324 which is slightly higher than the property you currently own. Plus the calculator also gives you the option to include a year-by-year depreciation schedule in the.

She uses Table 2-2d to find her depreciation percentage. The MACRS Depreciation Calculator allows you to calculate depreciation schedule for depreciable property using Modified Accelerated Cost Recovery System MACRS. A general depreciation system uses the declining-balance.

The depreciation amount changes from year to year using either of these methods so it more complicated to calculate than the straight-line method. This calculator will calculate the rate and expense amount for personal or real property for a given year. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

This MACRS depreciation calculator gives the user the information they need to aid them in making the tax conscious decision. As specified for residential rental property Eileen must use the straight line method of depreciation over the GDS or ADS recovery period. She chooses the GDS recovery period of 275 years.

The declining balance approach with switching to straight line method Only the straight-line method. 10-year property 15-year property 20-year property 25-year property 275-year residential. Our rental property depreciation calculator is free and easy to use.

The propertys basis the duration of recovery and the method in which you will depreciate the asset. D j C-S nn dC-S n SLNC S n n In the straight-line method the depreciation amount is a constant percentage of the basis equal to d1n. Assuming the machine has a salvage value of 400 you can depreciate 1200 of the cost over the life of the copier.

Now we are armed with the two components of the formula and we can plug these numbers directly into the formula to calculate gross rental yield. In the year that the rental is first placed in service rented your deduction is prorated based on the number of months that the property is rented or held out for rent with 12 month for the first month. Straight-line depreciation is the simplest depreciation method to calculate.

The amount of depreciation each year is just the depreciation basis Cost C - Salvage Value S n divided by the useful life n in years. Final value residual value - The expected final market value after the useful life of the asset. By convention most US.

We welcome your comments about this publication and your suggestions for future editions. Asset value - The original value of the asset for which you are calculating depreciation. Calculate depreciation used for any full year and create a depreciation schedule that uses mid month convention and straight-line depreciation for residential rental or nonresidential real property related to IRS form 4562 lines 19 and 20.

Since she placed the property in service in February the percentage is 3182. We will use the ordinary annuity. Calculate depreciation and create a depreciation schedule for residential rental or nonresidential real property related to IRS form 4562.

General Depreciation System - GDS. Period - The estimated useful life span or life expectancy of an asset. Property depreciation for real estate related to MACRS.

The most commonly used modified accelerated cost recovery system MACRS for calculating depreciation. The straight-line method or the accelerated method. Private mortgage insurance or PMI is a type of insurance typically required by the mortgage lender when the borrowers down payment on a home is less than 20 of the total cost of the home.

Methods Of Depreciation.

Straight Line Depreciation Formula And Excel Calculator

Straight Line Depreciation Formula Guide To Calculate Depreciation

Straight Line Depreciation Calculator Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense

Residential Rental Property Depreciation Calculation Depreciation Guru

How To Calculate Straight Line Depreciation Depreciation Guru

Depreciation Schedule Template For Straight Line And Declining Balance

What Is The Straight Line Depreciation Formula How To Calculate Straight Line Depreciation Video Lesson Transcript Study Com

How To Calculate Depreciation On Rental Property

Straight Line Depreciation Calculator And Definition Retipster

Straight Line Depreciation Calculator And Definition Retipster

Method To Get Straight Line Depreciation Formula Bench Accounting

Straight Line Depreciation Formula And Excel Calculator

Residential Rental Property Depreciation Calculation Depreciation Guru

Straight Line Depreciation Template Download Free Excel Template

How To Use Rental Property Depreciation To Your Advantage

How To Calculate Straight Line Depreciation Depreciation Guru